What Exactly is a Virtual Card

Virtual cards (also known as “Disposable cards“,) are randomly generated temporary cards that you can use for purchases and payments online, just like your regular physical credit and debit cards from your banks. The only differentiating factor is that, unlike your regular debit card, you cannot hold or swipe it at point-of-sale (POS) terminals – it isn’t handy, basically.

GTBank Virtual MasterCard: How to Get One

GTBank – just like other financial service providers in Nigeria – offers virtual card services to its customers. The GTBank Virtual MasterCard is a digital payment card designed to aid frequent online shoppers with a secure and flexible alternative to physical payment cards. The virtual card is instantly issued via Internet Banking and as a customer of Gtbank, you can apply for a Virtual Mastercard. Here’s how to apply for one:

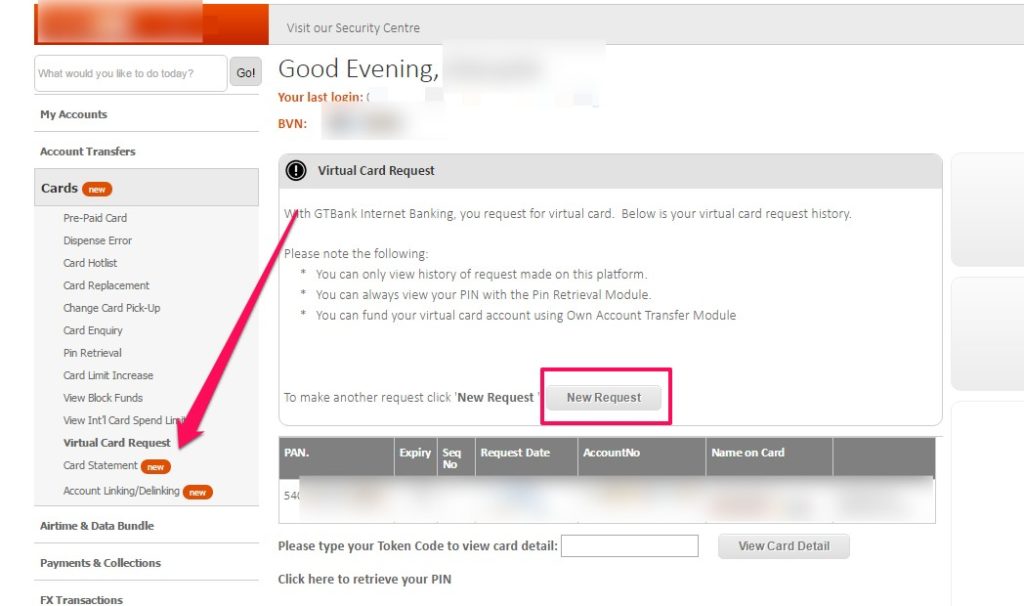

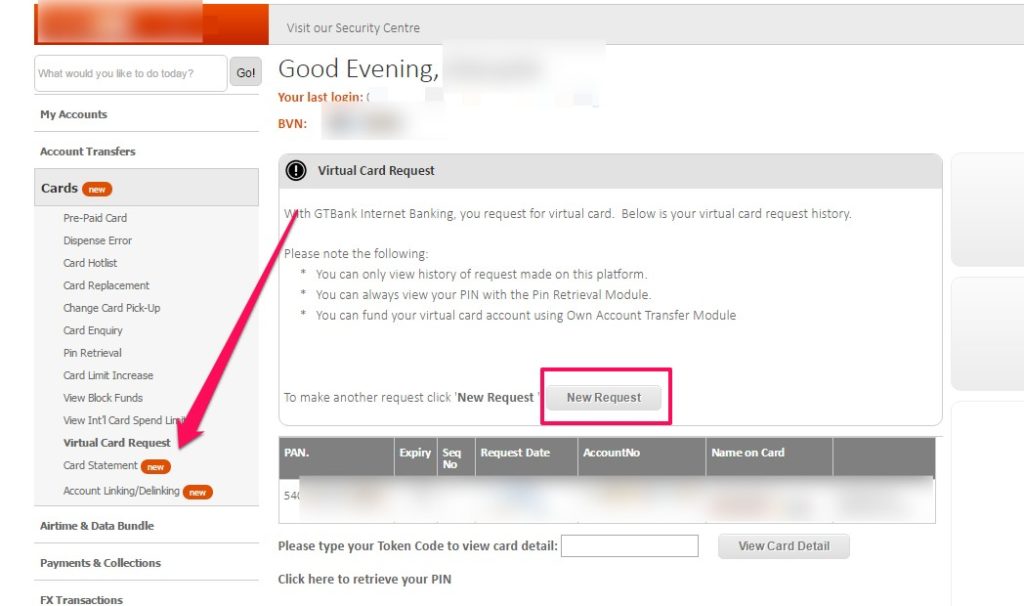

Log in to the Internet Banking PlatformSelect Cards from the left-hand panelTap on the Virtual Card request menu and fill in the displayed form.Tap the New Request Button to request a new virtual Pre-paid cardNext, click on the ‘Account to link’ and click the “Terms and Conditions” checkbox.You’ll then need to generate a 6-digit code from your hardware token deviceInput the generated 6-digit token code on the confirmation page and click the ‘Submit’ buttonIf successful, Internet Banking will display the details of your virtual card.

In conclusion, you should note that all GTbank virtual cards are valid for 3 years. You would need to reapply for a new one after 3-years. The daily loading limit on the GTbank virtual Mastercard is N100,000, the Daily maximum card balance is N500,000, and local web transactions is N500,000 daily.